Mileage tracking feature in SpinTrace

Do you have to do mileage tracking?

Before we look at how mileage tracking is done in SpinTrace, let's find out why you should do it in the first place. There are several reasons why you need or want to do mileage tracking:

You want to apply for mileage reimbursement

In USA and some other countries, the tax regulator provides a possibility of mileage reimbursement – a certain

amount of money

is reimbursed to you for each mile of your business-related trips. However, you

have to keep track of each such business trip. For example, IRS (the tax regulator in the USA) issues standard

mileage

rates for each year. You, as a business owner, then have to provide the report with details about each of the

business trips, together with a total sum of the business-related mileage.

Along with the mileage rate, you can then calculate how much money you can reimburse. Even here, SpinTrace helps

you to track such data and generate such report. Miles then equal money!

Your local tax regulator requires you to collect business trip data

In many countries, you can apply for various tax deductions once you use your car or cars for business purposes. However, in such situation, the tax regulator usually requires you to track data about usage of your car, the trips you’ve made, whether they were business-related or not, what purchases you’ve made in relation to the vehicle etc. Only then, if all data are properly recorded and are valid, you are allowed to apply for such tax deductions. SpinTrace helps you to track such data and keep them in a single place, available to you anytime you are requested to provide them.

You are obliged to keep historical records

Tax regulators usually require that business trip data are kept for several years. To have a possibility to review this data when needed. SpinTrace helps you to store such data indefinitely and keep them safe. We have backups. And backups of backups.

How to track mileage using SpinTrace?

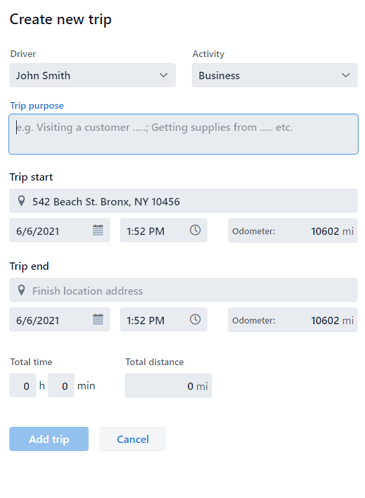

One of the essential features of SpinTrace is a business trip log – mileage tracking of your business vehicles. SpinTrace allows defining as many trip logs as you need – where each trip log represents a single car. Once a new trip log is created, and necessary data about the vehicle are provided, your employees can start adding trips to it. Each trip is recorded with many important data, like address, time and an odometer value at both the beginning and end of the trip. The application also tracks a driver of each trip and whether it was personal or business-related. SpinTrace uses all these data to generate various reports, which are useful not only for company fleet management and statistics but also for tax-related reporting.

Tracking in a multi-user environment

Mileage tracking is user- and role-sensitive. That means that the trip can be edited (or removed) only by the user who created the trip record. Other users who have access to the application, can usually view such record, but they do not have permission to change or remove it. There is, however, one superuser role, which has higher privileges: We call this role a “Fleet Manager” and users, who have this role assigned, can add, edit or remove any trip record of any driver. It’s best to assign this role to an employee, whose responsibility is to keep order in the fleet management data. Example usage of such high privilege is the following situation: One employee (the driver) enters the trip data incorrectly, but leaves for vacation and is unreachable. That means the driver cannot fix the record by himself. The “Fleet manager” can then log in to SpinTrace, find the corrupted record, and fix it instead of the driver.